Structuring your business

Check-in UK

The UK has long been regarded as a springboard for businesses headquartered outside of the UK into the rest of Europe as well as a natural market for other European businesses to expand into. Many inward investors from outside Europe choose, at least in the early days, to service the rest of Europe from the UK. The English language and business culture together with fewer constraints on commerce and a highly skilled workforce make the UK an attractive place to do business. With the right planning - including specialist, co-ordinated advice at an early stage - the majority of all of the legal work needed to get started in the UK can be done quickly and inexpensively.

Taken from "Check-in UK", our concise guide to setting up and doing business in the UK, the following article examines the issues to be aware of when structuring your business.

Structuring your business

A key part of successfully setting up and doing business in the UK is to establish the appropriate business structure. This will usually include:

- the registration or incorporation of an entity in the UK; and

- taking steps early in the process to consider the most appropriate structure from a commercial, corporate and tax perspective.

Hot topics

Do we need a UK entity? In most cases the answer to this question will be yes as:

- English company law is likely to require it; and

- an entity helps the business to ensure it is managing international tax issues appropriately. Without an entity, the overseas entity may find it has an unregistered branch in the UK which could well constitute a UK permanent establishment for tax purposes.

- Cost plus: many emerging overseas corporates start doing business in the UK using the "cost plus" method of trading. In this model the UK operation provides sales and marketing services to the parent entity, for which it is paid its costs plus a mark-up for transfer pricing purposes. Customers contract directly with the overseas parent, which recognises the revenue rather than the UK entity. Many businesses then move to a different arrangement at some point in their growth. That said, with UK corporation tax rates currently at a very competitive level compared to many economies there is an increasing trend toward having more functions based in the UK with correspondingly greater profit attributed to and taxed in the UK.

- The UK as a holding company: given the UK's competitive corporation tax rate, which the Government is in the process of reducing to 20% over the next few years, and other inherent advantages such as the availability of talent, the sophisticated professional services and market infrastructure, a business friendly regime and the attractiveness to overseas employees, we are seeing overseas and international corporates increasingly considering the UK as a holding company jurisdiction for worldwide / non-domestic sales. Research and development credits may be available and the UK Patent Box regime is a further incentive for businesses with UK or European Community patents to obtain an effective corporation tax rate of 10% in the UK over time on revenues derived from qualifying patents (subject to satisfying the relevant requirements).

Key legal considerations

Trading in the UK

Trading in the UK

Inward investors use a number of different structures to enter the UK market. The right structure will depend on factors such as the specific sector, business product, service and the extent to which a local presence is required. Examples include:

- trading through a limited liability company (or a group of companies);

- setting up a UK establishment (which until quite recently was referred to as either a "branch" or a "place of business");

- running the business from outside the UK via the internet or otherwise selling directly into the UK;

- using a franchise or licensing model;

- using a distributor or agent;

- using a joint venture with a third party;

- acquiring an existing business in the UK; and/or

- entering into a partnership with another business. Limited partnerships and limited liability partnerships can be formed in the UK in addition to traditional partnerships.

Choice of entity

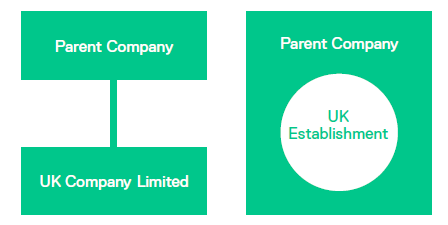

The two entities typically used by overseas investors setting up in the UK are either a limited company or a UK Establishment (often referred to as a "branch").

Most choose a limited company, which is usually set up as a wholly owned subsidiary (i.e. 100% of the shares are owned by the overseas parent). Common reasons for choosing a company include the additional commercial credibility that can be achieved by showing commitment to the UK market and the additional limitation of liability it provides. When compared to a UK establishment, it also protects the parent corporation's financial statements from public disclosure in the UK.

UK companies have accounting, tax, audit and regulatory requirements that need to be complied with. A UK company can be formed within one day.

UK Establishments can be a useful alternative to a company in some cases. There may be commercial or other reasons why a business might choose a UK Establishment. Often this is because a UK Establishment is seen as a lighter form of entry into the UK market with lower regulatory requirements and maintenance costs than a company. This can be an attractive option for inward investors who want to make a tentative first step into the UK market or where the levels of activity in the UK are likely to remain limited.

A UK Establishment is a registration that the overseas entity itself is doing business in the UK. Accordingly, the UK Establishment is not a separate legal entity to the entity which has the UK Establishment; it has no limited liability status.

A UK Establishment can be taxable or non-taxable.

Any liabilities of the UK Establishment will be liabilities of the parent entity which has registered the UK Establishment.

UK Establishments have accounting, tax and regulatory requirements that need to be complied with. These include filing the annual financial statements of the entity holding the UK Establishment on the public record at Companies House. This can be a material concern for corporations from jurisdictions (such as the USA) with a lower (or no) level of public disclosure requirements for financial statements. Alternatives to avoid this disclosure include setting up a UK company or setting up a new corporate entity in the business' own jurisdiction to hold the UK Establishment.

Name availability

For a company or UK Establishment to be registered at Companies House, the name of the proposed entity cannot be identical or too similar to that of an existing company or UK Establishment on the public register. In addition to checking the register when forming the entity, it is advisable to carry out a trade mark search to assess the risk that the use of the proposed name may infringe an existing registered trade mark. It can also be helpful to use a search engine to investigate whether the proposed name is similar to any other existing business name in the same or a similar trade, where there could be a risk of a "passing off" action being brought by the existing business under English law, where that pre-existing business has established goodwill in the name and there is a risk of confusion.

A list of companies and UK establishments registered in the UK can be found on the Companies House website.

Methods of trading

Whichever UK entity is set up, the business needs to consider how it will trade. Will customers contract with the UK entity directly or with the parent corporation? Which entity in the group will own the intellectual property?

Whichever UK entity is set up, the business needs to consider how it will trade. Will customers contract with the UK entity directly or with the parent corporation? Which entity in the group will own the intellectual property?

Specific tax advice should be obtained and the relevant tax and commercial issues will need to be considered carefully in each case. Typical structures include:

- a commission and/or cost plus arrangement (as referred to in the trends and hot topics section above);

- a distributor / stripped distributor / limited risk distributor arrangement;

- a buy / sell arrangement; or

- in some cases a combination of some of the above.

Bank accounts

Due in some part to the "know your client" rules which are prevalent across Europe, it can take some time to set up a bank account once a UK entity has been established. However, unlike many other jurisdictions, it is not necessary to establish a bank account before registering an entity in the UK.

If you have any questions on this article or would like to propose a subject to be addressed by Synapse please contact us.